A Handy Guide to Holiday Let Mortgages

The global pandemic, lockdown and ongoing overseas travel restrictions have created a huge demand for ‘staycation’ holiday let properties in the UK. Savvy investors are taking advantage of this revenue stream, plus the stamp duty holiday and low-interest rates to invest in holiday lets.

If you’re thinking of taking advantage of this market trend and invest in a holiday home, you may need to take out a holiday let mortgage.

In this article, we’ll look at:

- What is a holiday let mortgage

- How to get a holiday let mortgage

- Typical lender criteria/requirements

- Tax benefits as a holiday let owner

- Tips when you’re applying for a mortgage

- How to choose a mortgage lender

What is a holiday let mortgage?

A holiday let is essentially a property you buy as an investment and a holiday let mortgage is a specialist product required for this type of purchase. It means that you can own your property, but with the purpose of commercially renting it out as short-term holiday accommodation.

You can apply for a holiday let mortgage if you’re:

- An individual/group of individuals

- A Partnership

- A Trust

- A Trading Limited Company

- An SPV Company

A holiday let mortgage means that you’ll be renting your holiday property out most of the time, with only occasional use by yourself or friends/family members.

Holiday let mortgages are a niche type of finance product, and it’s common to find that lenders offering them are the smaller-sized building societies. Just because it’s a niche product, it doesn’t mean that this kind of mortgage isn’t readily available. You can also use a mortgage adviser to help you locate the best deals out there.

It’s crucial to note at this point, that a holiday let mortgage is not the same as a mortgage you’d use to purchase a buy-to-let property*. There are different terms and conditions at play where a buy-to-let mortgage contract is concerned, and it will usually include the fact that an Assured Shorthold Tenancy (or AST for short) is in place.

How your maximum loan size is calculated will also differ between a holiday let mortgage and a buy-to-let.

Note: If you’re planning to purchase a new residential property (in addition to your main residence), with only occasional periods of renting it out as a holiday home, then what’s commonly known as a ‘second home mortgage’ will likely be more suitable for you.

A residential mortgage for a UK holiday let

A second home mortgage is usually a little more straightforward to arrange. It means you’re applying for a standard mortgage, but it may be called a ‘second home mortgage’ if you already hold a mortgage on another property that you use as your main residence.

A minimum deposit of 25% is the usual standard when it comes to mortgages of this type, and you may also attract slightly higher interest rates and fees for it; compared to a regular mortgage product.

Having an existing mortgage in place can mean that, when you apply for a second mortgage, lenders’ assessment criteria and indeed their terms and conditions can be a bit stricter. They will also look at your existing repayment history on your existing property, which contributes to their assessment of ‘how risky’ a borrower you might be.

*If you’re planning to take out a standard residential mortgage for a holiday home, do take care on timings if you’re hoping to allow others to use it. Some terms and conditions set time limits on this kind of use – or even prohibit it altogether

How to get a holiday let mortgage

Firstly, consider whether you want to hire a mortgage professional to help you find the best deal, or whether you’d prefer to handle it all alone.

As we’ve already mentioned, because holiday let mortgages are a specialist mortgage type, it can sometimes be worth investing in some professional advice from an expert who knows the market and how it works.

They can help you overcome hurdles such as, for example, trying to understand whether you will even pass a lender’s rental income ‘stress test’ using a holiday let income projection.

An income projection for your holiday let is generated using information from either a national or local holiday letting agency. Evidence of this projection will be required at the mortgage application stage, where it’s then eventually supplied to the lender’s surveyor to comment on as part of the overall surveying process.

This approach is taken because it’s a well-known fact that income generated from holiday homes can be a very ‘seasonal’ business, with lots of variation, so lenders often look to a holiday letting agent for realistic advice on the market in a certain geographical area.

Note: Your lender will probably be looking for returns where at least 125% of mortgage interest payments can be covered (when calculated using a 5.5% interest rate).

Most commonly, you’ll be able to borrow up to 75% of the property’s value for a holiday-let mortgage. If you can bring that figure down to around 60%, you’ll likely access some better mortgage deals too.

A lender will sell you a mortgage on a ‘non-advised basis’; meaning that they won’t advise on the suitability of your mortgage basis on your individual needs and circumstances (this is one factor that happens to be the same as a buy-to-let mortgage).

*Attempting to use a buy-to-let mortgage for a holiday let property without your lending institution’s formal permission will constitute a breach of the mortgage conditions and can be classed as fraudulent. This in turn can lead to serious repercussions – for example, you could incur damage to your credit rating and there may be a forced redemption of the mortgage.

Types of mortgages

When you’re applying for a holiday let mortgage, you’ll need to decide whether you’d like to take out an interest-only or repayment mortgage. Whilst interest-only mortgages can mean smaller monthly payments, your balance will not be reducing over the time of your mortgage term, so you still need to be sure that you repay the capital at the end of this period.

You’ll also need to take a look at lenders’ fixed, variable and discount mortgage rates on repayments to decipher what the most affordable option for you will be. Each of these lenders will be offering different options of course, for example, fixed-term for three years, five-year variable rate or perhaps only discounted rates.

As well as the mortgage itself, do remember that you’ll be paying fees such as legal, arrangement and surveying fees too, in order to complete the deal.

The criteria for lending

Each financial institution will have its own set of rules, but criteria items will usually include things such as the following:

- Applicant/s need to be over the age of 21

- Applicant/s must be UK citizens with at least 3 years of address history

- All applicants (or the lead applicant) will need to already own their own home

- Applicant/s must hold a very good credit history

- Applicant/s must be able to raise a deposit of at least 25% (possibly more)

- Applicant/s must satisfy minimum income requirements (this will vary depending on loan size needed and the number of people applying)

- Confirmation that the property to be purchased will not be lived in as a ‘main residence’ by anyone

- Geographical locations within the scope: England, Wales, Scotland (including Skye, Aran, Mull and certain other Inner and Outer Hebrides)

- Construction type: e.g., “all types except 100% timber are accepted”

- Lending limit: Loan to value (LTV):

-up to 60% LTV to a maximum loan of £750K available on standard products

-up to 75% LTV, a maximum loan of £1.5m on standard products

What does ‘loan to value’ (LTV) mean?

LTV ratio is a number lenders use to determine how much risk they’re taking on with a secured loan. It measures the relationship between the loan amount and the market value of the asset securing the loan, such as a house or car.

If a lender provides a loan worth half the value of the asset, for example, the LTV is 50%.

Loan-to-value ratio can apply to any secured loan but is most commonly used with mortgages.” (Definition from Experian)

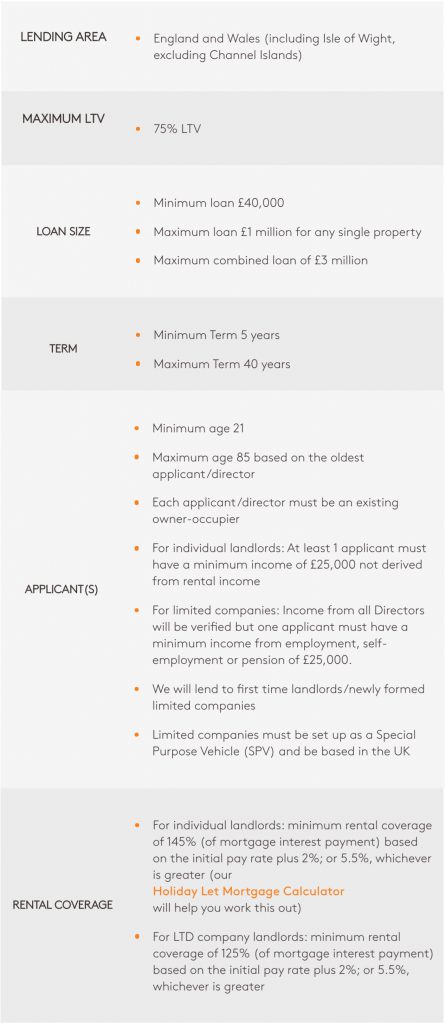

Here’s an example of what one existing lender states as their criteria:

Example from Monmouthshire Building Society: The criteria above is for standard Holiday Let Mortgages for up to three properties.

What other kinds of circumstances might also be accepted by lenders?

- Applicants who are ex-pats

- Applicants with property portfolios, including portfolios of holiday lets are acceptable

- Submitting a deposit where some or all of the deposit has been ‘gifted’ by very close family members (e.g. mum and dad) – provided that the gift is non-returnable (without reservation)

- In some cases, no minimum personal income may be required

- Where the property you want to take a mortgage out on is made up of multiple units, is a mixed-use holiday let, or a barn conversion (meant for holiday let use only)

Note: Every lender is different, so if a case is outside their holiday let mortgage criteria, it may still be considered based on its merits.

Holiday let mortgage tax benefits

If you end up successfully obtaining a holiday let mortgage, and your holiday home can be categorised as a ‘Furnished Holiday Let’ (FHL), you may be entitled to a certain level of tax relief. To qualify for holiday let tax advantages, the property must be furnished, available for letting for 210 days a year, and actually let for 105 days.

This is because it can then be classified formally as a ‘business venture’; granting you eligibility for receiving tax relief on mortgage interest payments (‘holiday letting’ in general is classed by HMRC as a business type).

Here are some other possible tax benefits that you may be able to enjoy (depending on your circumstances)*:

- You may be able to claim Capital Gains Tax reliefs for Traders (Business Asset

Rollover Relief, Entrepreneurs’ Relief) - You may be entitled to Capital Allowances for certain items (e.g. fixtures and furniture)

- The new treatment on buy-to-let finance costs does not apply to furnished holiday lets (FHLs)

- All your FHLs in the UK can be taxed as a single UK FHL business, and all FHLs in other EEA states are taxed as a single EEA FHL business

Please note: The above are highlights, and are not intended as any form of formal Tax advice.

How to choose a holiday let mortgage lender

Here are some typical issues you should consider and factor into your research and consideration process:

- Does the lender offer holiday let mortgages? It’s worth checking this before getting too far into the first stages of the application process

- Will they accept your income situation? This is important to consider if you’re self-employed or you’ve had a recent change of employer/job

- Will they lend for properties like the one you are hoping to purchase? Particularly important if you suspect the property is ‘unusual’ in some way

- Does the property have to be a holiday let already? Certain lenders will only accept mortgage applications for existing holiday lets

- Are there any specific lending criteria that you should know about?

Already seen a property you want to snap up? Our top tips for securing a holiday let mortgage:

1. Make sure that your paperwork is ready to go

Lenders will usually want to see evidence such as several months’ worth of personal and business bank statements, a valid passport and/or a driving licence, proof of your earnings (contracts or trading accounts if you don’t work via contracts) and proof of deposit.

2. Get your deposit ready

Whether you’re receiving a gift from close family or you’ve been saving hard, have this ready and within reach before you begin the mortgage application process.

3. Double-check your credit score

Whether you can use a free account or need to pay a small amount to access it, it’s worth looking into your current credit health to make sure it’s good enough to proceed with your holiday let mortgage application. It may also be worth tying up any loose ends regarding store cards and credit cards, so that these open accounts aren’t holding you back.

4. Keep an eye on how the market is behaving

In the run-up to your application, it will be of benefit to you to keep a watchful eye on how property prices are behaving in the area you want to buy in. You should also do a bit of research to collect information on average/likely costs of things such as utilities, building maintenance, and council tax, so that you can factor this into your future business budgeting. It means that you’ll be working with more realistic running costs.

5. Consider speaking to a holiday let mortgage expert

Whilst this will attract an additional cost, speaking to a market expert – especially for a financial product this specialist in nature – might be well worth it in the end. They’ll be free to find the best-looking lending options for you, and they can also represent you in negotiations so that you land on a deal which works for you.

6. Speak to a specialist holiday letting agent

Once you’re ready to apply for a mortgage, contact a professional letting agency for guidance on average booking levels and rental income for your chosen area. They can offer support for your application if you are going to let your rental through them.

Who offers holiday let mortgages?

Here are just a handful of UK-based financial institutions we found who offer this mortgage type:

- The Cumberland (For Business)

- Teachers Building Society

- Furness Building Society

- HCM

- Hodge Bank

- Monmouthshire Building Society

Whilst the pool of specialist lenders of this kind is still relatively small, it’s still a market that is well-established and competitive, so you should be able to seek out some good deals for your purchase.